child tax credit 2022 extension

However Republican Senators Mitt Romney Richard Burr and Steve Daines. As Tax Day approaches on April 18 Bennet also highlighted that eligible families can claim the second half of their expanded CTC as well as their full expanded Earned.

Money Management Living Well In The Panhandle

Families must have at least 3000 in earned income to claim any portion of the credit and can receive a.

. Payment 2 is due on June 15 2022. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. 935 ET Dec 29 2021.

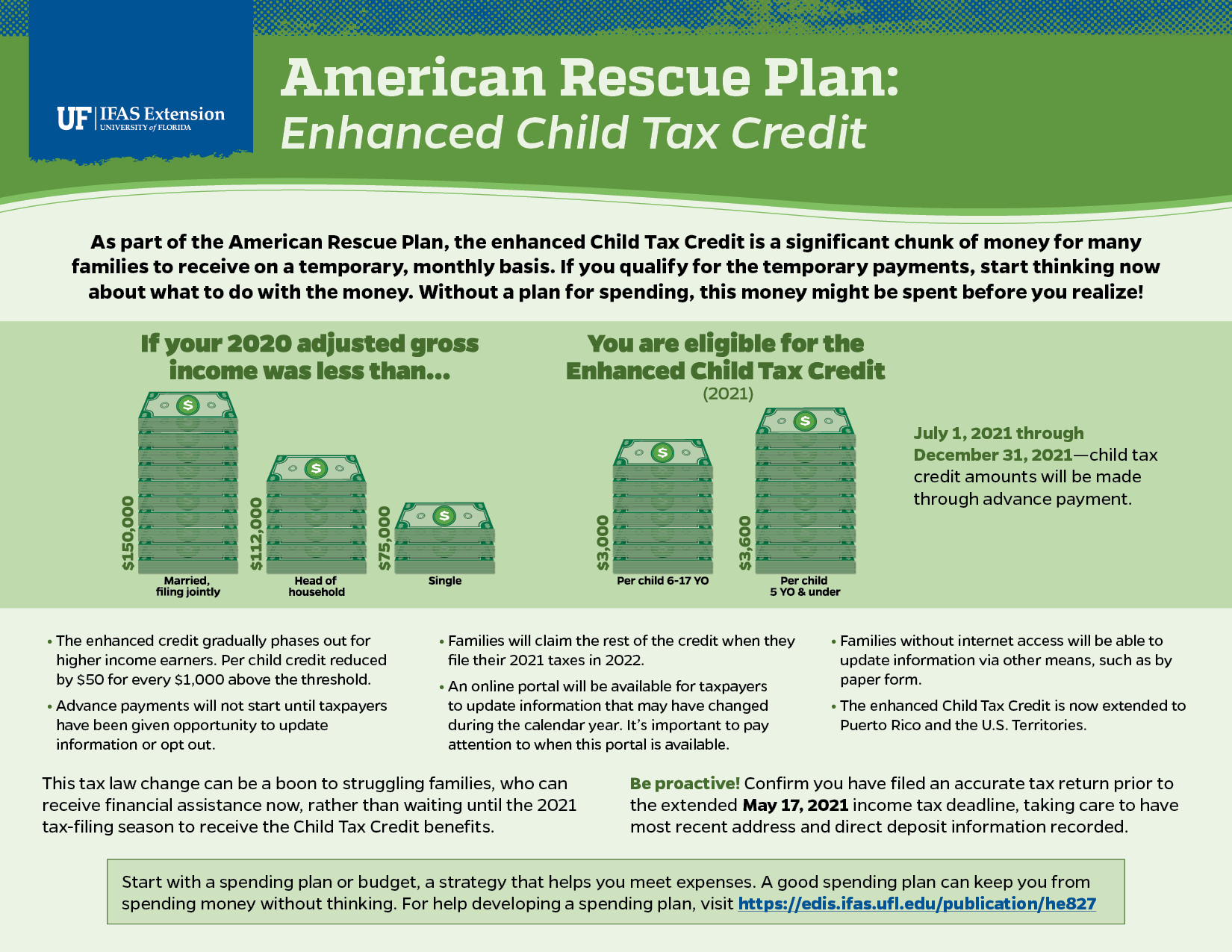

The enhanced Child Tax Credit payments where distributed last year from July through December. Time is running out to claim the expanded Child Tax Credit that could bring an eligible family as much as 3600 per. Couples earning as much as 150000 a year could receive the full 3600 benefit 3000 for children 6 and older and even wealthier families qualify for the original 2000.

The quarterly payment schedule for the estimated tax payments in 2022 is as follows. One provision tens of millions of American families likely want to know is whether the expanded child tax credit implemented in July will continue into 2022As part of a COVID. Payment 1 is due on April 18 2022.

Families could be eligible to. 2 days agoSocial Security Administration announces new payments up to 4194 in November. The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000 for.

How does the first phaseout reduce the 2021. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. Blaming Manchin might be the path of least resistance.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. As Congress failed to agree on a Child Tax Credit extension payments will return to 2000 for 2022. The legislation made the existing 2000.

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. Have been a US.

With the deadline to apply for stimulus checks and the Child Tax Credit nearing the end nearly. For additional information on the amounts of modified AGI that reduce the 2021 Child Tax Credit see Q C4 and Q C5 below. Child tax credit extension 2022 when is the deadline and will there be payments next year.

October 6 2022 809 AM CBS Los Angeles. Budget restraints only allowed the credit revamp to be temporary. 1406 ET Dec 27 2021.

6728 with three or more qualifying children in 2021 to 6935 with three or more qualifying children in 2022. The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000 for. These payments were part of the American Rescue.

The child tax credit CTC will return to at 2000 per child in 2022. According to Welsh the maximum credit shifts are.

Will I Receive The Child Tax Credit In 2022

2021 Child Tax Credit Earned Income Tax Credit Child Dependent Care Deductions Alabama Cooperative Extension System

Will Child Tax Credit Payments Be Extended In 2022 Money

Study Claims Parents Will Quit If Child Tax Credit Payments Are Extended Does Stimulus Hurt Labor Fingerlakes1 Com

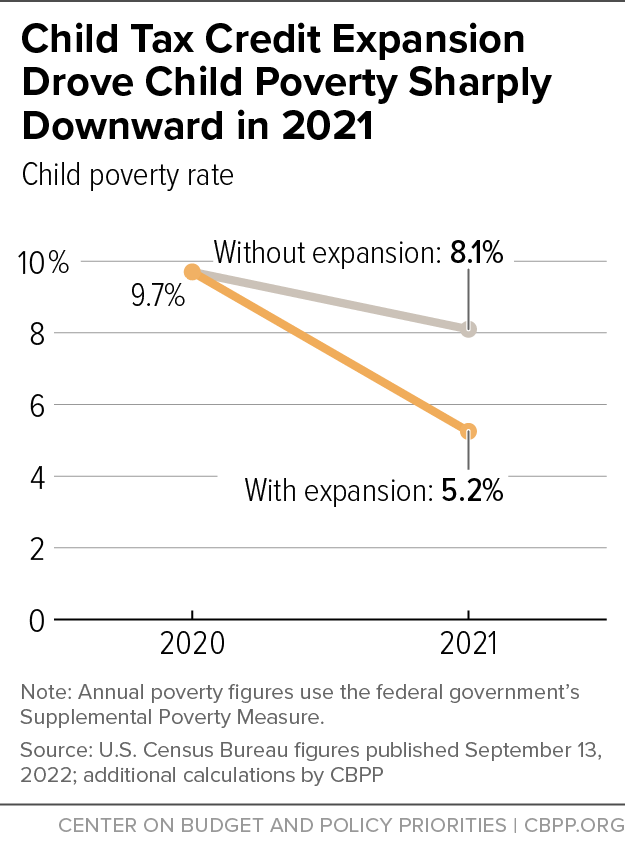

Policymakers Should Expand Child Tax Credit In Year End Legislation To Fight Child Poverty Center On Budget And Policy Priorities

What Is The Child Tax Credit Tax Policy Center

Child Tax Credit Is December The Last Monthly Payment Will They Be Extended Into 2022 Al Com

Child Tax Credit 2022 Who Will Be Eligible For Ctc Extension Payments Marca

Child Tax Credit 2022 What Changes Will There Be In The New Tax Season As Usa

/cdn.vox-cdn.com/uploads/chorus_image/image/70269933/GettyImages_1328725400.0.jpg)

Unless Congress Passes The Build Back Better Act The Child Tax Credit Will End In December Vox

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit Payments 2022 Is There A Plan B If They Are Not Extended Next Year Marca

The American Families Plan Too Many Tax Credits For Children

Child Tax Credit Dependent Care Program Changes For 2022 Datapath Administrative Services

2022 Child Tax Credit How Expansion Could Eliminate Poverty For Millions Cnet

Will The Monthly Child Tax Credit Payment Be Extended Next Year The Us Sun

How Monthly Child Tax Credit Checks May Be Renewed By Congress

Why Do I Get 300 250 From Child Tax Credit And Not 3 600 3 000 As Usa

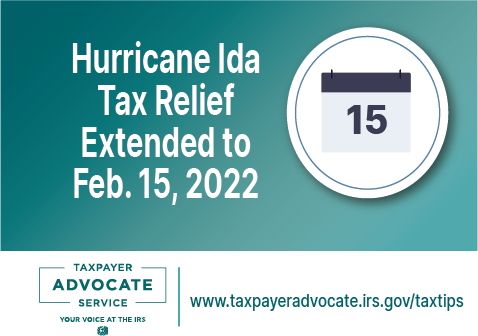

Tas Tax Tip Hurricane Ida Tax Relief Extended To Feb 15 2022 Tas